Another tid bit from Tesla

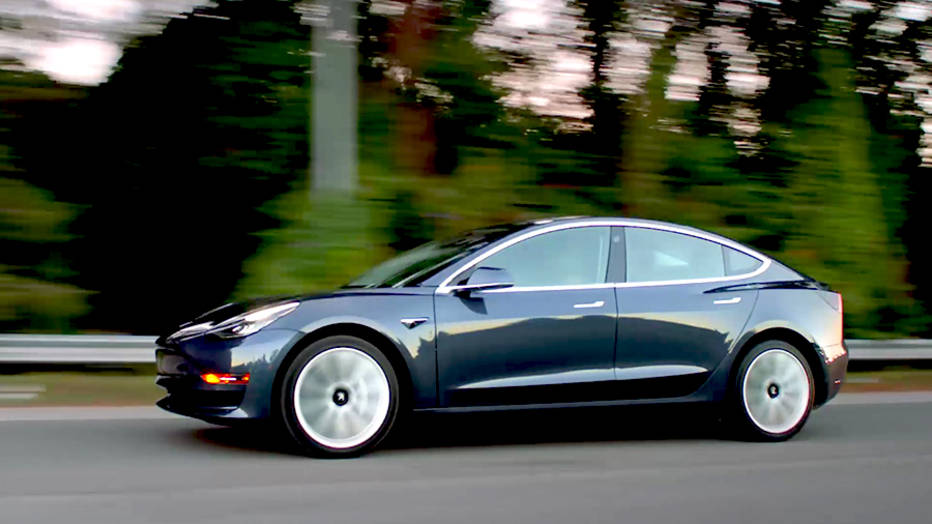

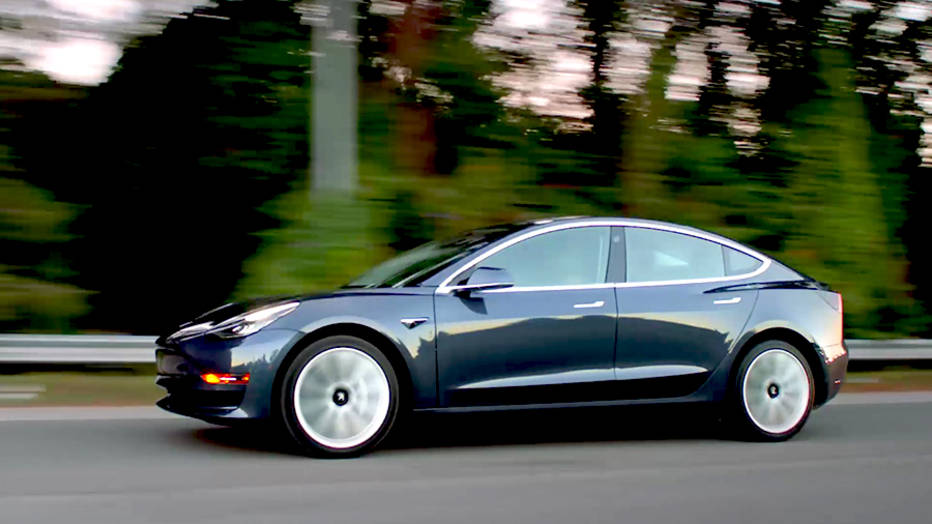

Production delays have plagued the Model 3 since July 2017, forcing production target setbacks.

Tesla is burning through $8,000 a minute as Model 3 production crawls along, report says

Automaker is spending $1 billion per quarter, needs another $2 billion by mid-2018

November 27, 2017

Share

Tesla CEO Elon Musk fully predicted the "production hell" the company would endure this year, signaling months earlier it would be a make-or-break moment for the electric automaker. But a full five months after production began, the Model 3 is a little difficult to spot even in EV-heavy areas of California.

The details surrounding Model 3 production delays remain a little murky: Battery assembly and steel welding were named as the main culprits by Tesla. The bottlenecks that have been holding up production for the last several months, at last report, appear to persist, and the company has taken the step of pushing back its production targets by a full three months to the end of March 2018. Tesla hoped to have ramped up production of its first truly volume car to 5,000 units per week by December 2017, but by the end of November has achieved a total production output numbering in the high hundreds, according to several reports.

These delays do not mean a lot of free time for Tesla workers; Bloomberg estimates that, despite the low Model 3 output, the company has been burning $480,000 an hour over the past 12 months, which works out to $8,000 a minute.

Green Cars

Opinion: Tesla dangles 2 shiny electric objects to distract from production reality

Elsewhere on this site is a story on the just-revealed Tesla Roadster. Tesla says 60 mph arrives in 1.9 seconds, 100 in 4.2 seconds, and the quarter-mile in 8.9 seconds. Top speed? 250 mph. Range ...

Tesla embarked on a cash-raising blitz earlier in the spring, accumulating some $3.2 billion ahead of the start of Model 3 production. But the company expected to be generating $175 million per week by December 2017 by producing (and selling) 5,000 Model 3s each week, taking the $35,000 base price at face value. Production delays now portend a significant cash crunch for the automaker -- Tesla has reportedly spent about half of the $3.2 billion in cash that it had saved up specifically for Model 3 production needs and is estimated to have spent $1.4 billion in the third quarter of 2017 alone.

Bloomberg now estimates that, at the current rate of cash burn, Tesla will exhaust its current cash reserves during the first week of August 2018.

A partial solution may arrive via sales of future vehicles that have not yet entered production, which is something Tesla is being criticized for once again, not without merit. Tesla unveiled the second-generation Roadster prototype to crowds gathered to watch the debut of the Semi truck, announcing that it will take deposits of $250,000 now for a "Founders Series" Roadster slated to enter production in 2020. This amount alone, with production for the Founders Series capped at 1,000 units, could generate $250 million, though the company is burning through $1 billion per quarter, as Bloomberg points out.

How much does Tesla need to stay afloat through the middle of 2018? Bloomberg estimates the automaker will require at least $2 billion in fresh capital by that point in time, based on a $1-billion-per-quarter cash burn estimate.

Bloomberg points out that Tesla could shore up the extra cash via a bond sale, even though buyers of debt are not making out very well at the moment after purchasing $1.8 billion earlier in the spring of 2017. Investors remain underwater even after the bonds recovered from a low of 93.88 cents on the dollar earlier in November.

Another option, short of a miraculous release of all production bottlenecks in the month of December, would be to sell more equity -- not the best course since it would dilute existing shareholders.

It remains to be seen if Tesla will be able to achieve the promised 5,000-cars-per-week target by late March 2018. Even though it is not running out of cash at the moment, it may run low on investor patience and brand enthusiasm unless things start heading in the right direction in the next three months.

Read more: http://autoweek.com/article/green-c...company-8000-minute-report-says#ixzz56U2f2LSz

Production delays have plagued the Model 3 since July 2017, forcing production target setbacks.

Tesla is burning through $8,000 a minute as Model 3 production crawls along, report says

Automaker is spending $1 billion per quarter, needs another $2 billion by mid-2018

November 27, 2017

Share

- Tweet

Tesla CEO Elon Musk fully predicted the "production hell" the company would endure this year, signaling months earlier it would be a make-or-break moment for the electric automaker. But a full five months after production began, the Model 3 is a little difficult to spot even in EV-heavy areas of California.

The details surrounding Model 3 production delays remain a little murky: Battery assembly and steel welding were named as the main culprits by Tesla. The bottlenecks that have been holding up production for the last several months, at last report, appear to persist, and the company has taken the step of pushing back its production targets by a full three months to the end of March 2018. Tesla hoped to have ramped up production of its first truly volume car to 5,000 units per week by December 2017, but by the end of November has achieved a total production output numbering in the high hundreds, according to several reports.

These delays do not mean a lot of free time for Tesla workers; Bloomberg estimates that, despite the low Model 3 output, the company has been burning $480,000 an hour over the past 12 months, which works out to $8,000 a minute.

Green Cars

Opinion: Tesla dangles 2 shiny electric objects to distract from production reality

Elsewhere on this site is a story on the just-revealed Tesla Roadster. Tesla says 60 mph arrives in 1.9 seconds, 100 in 4.2 seconds, and the quarter-mile in 8.9 seconds. Top speed? 250 mph. Range ...

Tesla embarked on a cash-raising blitz earlier in the spring, accumulating some $3.2 billion ahead of the start of Model 3 production. But the company expected to be generating $175 million per week by December 2017 by producing (and selling) 5,000 Model 3s each week, taking the $35,000 base price at face value. Production delays now portend a significant cash crunch for the automaker -- Tesla has reportedly spent about half of the $3.2 billion in cash that it had saved up specifically for Model 3 production needs and is estimated to have spent $1.4 billion in the third quarter of 2017 alone.

Bloomberg now estimates that, at the current rate of cash burn, Tesla will exhaust its current cash reserves during the first week of August 2018.

A partial solution may arrive via sales of future vehicles that have not yet entered production, which is something Tesla is being criticized for once again, not without merit. Tesla unveiled the second-generation Roadster prototype to crowds gathered to watch the debut of the Semi truck, announcing that it will take deposits of $250,000 now for a "Founders Series" Roadster slated to enter production in 2020. This amount alone, with production for the Founders Series capped at 1,000 units, could generate $250 million, though the company is burning through $1 billion per quarter, as Bloomberg points out.

How much does Tesla need to stay afloat through the middle of 2018? Bloomberg estimates the automaker will require at least $2 billion in fresh capital by that point in time, based on a $1-billion-per-quarter cash burn estimate.

Bloomberg points out that Tesla could shore up the extra cash via a bond sale, even though buyers of debt are not making out very well at the moment after purchasing $1.8 billion earlier in the spring of 2017. Investors remain underwater even after the bonds recovered from a low of 93.88 cents on the dollar earlier in November.

Another option, short of a miraculous release of all production bottlenecks in the month of December, would be to sell more equity -- not the best course since it would dilute existing shareholders.

It remains to be seen if Tesla will be able to achieve the promised 5,000-cars-per-week target by late March 2018. Even though it is not running out of cash at the moment, it may run low on investor patience and brand enthusiasm unless things start heading in the right direction in the next three months.

Read more: http://autoweek.com/article/green-c...company-8000-minute-report-says#ixzz56U2f2LSz