It’s not cheaper, but rather high quality at a somewhat lower MSRP. More affordable based on lower cost battery technology and mass market appeal. Elon expected around 60,000 Model 3 Reservations and too his surprise 200,000 rolled in within a couple days and currently stands at 400-500,000 units. The glitch is supplier parts and scaling production numbers to a level that went well beyond his expectation. If it’s production hell, it’s good that it’s a high demand production hell, based on a proven market, rather than production hell based on delivering a few thousand pre-orders with no proven market acceptance, followed by little market demand for a new class of vehicle.More FUD to chew on:

One thing to remember is this. Tesla has been building complete cars since 2012 (I won't count the original roadster). They had around 5 years of building cars and SUV's. Now they are going into a cheaper and higher volume unit. With that, they are struggling. It shows that when you try to make something cheaper on a larger scale, it's not as easy as it looks, even though they have vehicle manufacturing experience.

With that being said, if Elio does get to production in 2019, I'd suspect they will be having a hard time just like Tesla and most likely, a harder time. This is because Elio has no manufacturing experience of building cars, plus they have to build a brand new engine too. This will be the first shot at it and they will have 65K customers chomping at the bit to get theirs. I suspect we will have people that will be around #1K in their SIL and be waiting 6+ months before their number comes up.

Just like Elon, Paul will be in manufacturing hell for a while and probably much deeper for a longer period of time.

-

Welcome to Elio Owners! Join today, registration is easy!

You can register using your Google, Facebook, or Twitter account, just click here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Little News From Tesla

- Thread starter Coss

- Start date

RSchneider

Elio Addict

It's a classic case of where you go to uncharted territory. So you have a major problem where you think the market is at X and you build from there. Then all of a sudden, you find out you were wrong and it's 2X. For Tesla it's a catch 22. They got way to many orders for what they can fill. As for Elio, the same thing can happen. They can be prepared to fill the 65K for the first year but get 2X the 100K they are expecting to get. So we migh see Elio with the problem of demand outstripping supply with what Tesla is going through right now.It’s not cheaper, but rather high quality at a somewhat lower MSRP. More affordable based on lower cost battery technology and mass market appeal. Elon expected around 60,000 Model 3 Reservations and too his surprise 200,000 rolled in within a couple days and currently stands at 400-500,000 units. The glitch is supplier parts and scaling production numbers to a level that went well beyond his expectation. If it’s production hell, it’s good that it’s a high demand production hell, based on a proven market, rather than production hell based on delivering a few thousand pre-orders with no proven market acceptance, followed by little market demand for a new class of vehicle.

Rob Croson

Elio Addict

Just because you get twice the orders you are expecting (or three or four times, etc.), doesn't mean you have to build them all RIGHT NOW! You can start at the pace you originally planned, at the original quality you planned, and ramp it up once you get your feet under you, and a proven production line producing proven product.

Or you can try to quadruple the pace, and potentially royally screw it up.

Tesla didn't *have* to try and produce 5,000 vehicles a week, and produce a product that is generating quite a few complaints, with several reviews taking the quality of the build. The Model 3 may end up being a really good product, but it's not starting that way.

Or you can try to quadruple the pace, and potentially royally screw it up.

Tesla didn't *have* to try and produce 5,000 vehicles a week, and produce a product that is generating quite a few complaints, with several reviews taking the quality of the build. The Model 3 may end up being a really good product, but it's not starting that way.

Mean while over in Europe, the news about Tesla looks even rougher:

Tesla: Second Look Even Worse

Feb. 8, 2018 1:04 PM ET

|

222 comments

|

About: Tesla Motors (TSLA)

Bill Maurer

Long/short equity, long only, short only, Growth

(13,376 followers)

Summary

Can new European markets gain enough Model S/X traction?

Model 3 goal timelines seem a bit confusing.

Q1 third party estimates continue to look very weak.

Late on Wednesday, I detailed my initial thoughts regarding Tesla's (TSLA) fourth quarter earnings report. While many headlines focused on the positives, like a top/bottom line beats and a reiteration of the Model 3 forecast, the quarter was tremendously helped by credit sales and working capital changes. After going through the conference call and taking another look at the published investor letter, things may be even worse than I initially thought.

The first item to note is something I only briefly touched on, and that's the possibility of more Model 3 delays. While Tesla maintained its forecast for 2,500 units of production by the end of Q1 and 5,000 by the end of Q2, it had a very cautionary statement about meeting this goal. As SA contributor Anton Wahlman expanded last night, there seems to have been a major push back of delivery timelines for Model 3 reservation holders. I also was curious about this Elon Musk's statement on the conference call:

That – with alleviating that constraint, that's what gets us to the roughly 2,000 to 2,500 unit per week production rate.

Musk is talking here about automated lines coming over from Germany to the Gigafactory, expected to arrive in March, but they have to be reassembled and then brought into production. That doesn't leave a lot of room for error if attempting to hit the end of Q1 goal, and notice how Elon said roughly 2,000 to 2,500? The bottom end of that range is 20% below Tesla's production forecast, and Tesla still then has to get these materials to the Fremont factory and into vehicles. Don't forget that Easter this year is a few weeks earlier, on April 1, so the final week of Q1 is partially a holiday week that could impact some production plans.

Another thing that struck me as odd is a statement regarding one of Tesla's biggest goals for the Model 3, the 25% gross margin figure. With delays continuing to pile up, Tesla is guiding to another negative gross margin quarter for the vehicle in Q1 2018, and this is still only while delivering the more expensive versions. While gross margins will improve as production ramps, the standard battery version that many are still waiting for will be lower margin. Also, will Tesla have to lower prices as competition arrives and Tesla consumers lose part to all of the tax credit after the 200,000 limit is reached? That gets me to two differing statements between the investor letter and conference call regarding this target:

Investor letter: Also, we are focused on achieving our target of 25% gross margin for Model 3 after our production stabilizes at 5,000 cars per week.

Conference call:

Ryan Brinkman - JPMorgan Securities LLC

Hi. Good afternoon. Thanks for taking my question. As you put solutions in place one by one to unclog Model 3 production bottlenecks in Fremont or at the battery module line in Reno, are you finding that the ultimate solution is more or less expensive to implement than your original plans, which called for 25% gross margin on the vehicle?

Elon Reeve Musk - Tesla, Inc.

I think we feel good about that. I think like – I think we probably are, we're probably able to exceed that next year, probably.

Now management is guiding to hitting the 5,000 per week mark at the end of Q2 this year, and further increasing capacity to move to 10,000 units per week, so shouldn't sustained production at 5,000 per week be like Q3 this year? By Elon saying it can exceed that gross margin target "probably" in 2018, it makes it seem like they really won't be able to sustain that 5,000 a week level for several quarters, or that the margin target won't come until quite a while after they hit the 5,000 a week rate. Perhaps I'm reading into this a little too much, but the wording just seems a little confusing here.

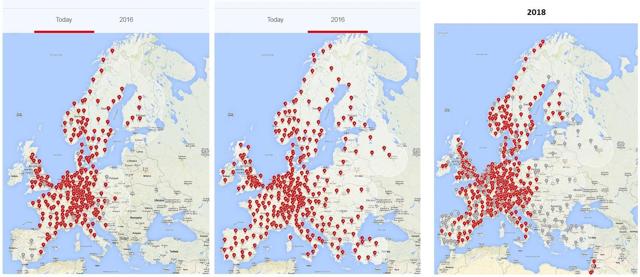

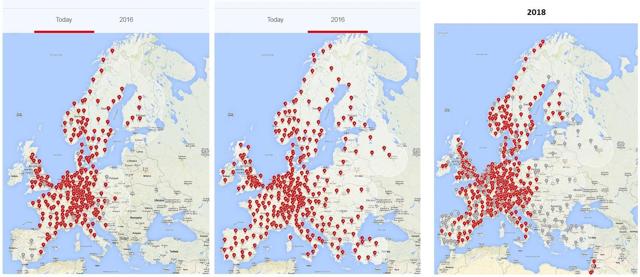

One thing that got my attention is Tesla's plan for the Model S and X to be at around 100,000 units this year. In the investor letter, the company attributed this to entering new markets which should allow orders to grow. If you look at the company's supercharger map for 2018, seen in the image on the right below, you'll notice a lot of plans for the expansion into countries like Turkey, Ukraine, etc. However, if you look at the image in the middle, Tesla was supposed to have these superchargers in place two years ago, and they now shown as "opening soon" in gray.

(Source: Tesla supercharger map)

(Source: Tesla supercharger map)

I bring up this issue of new markets because gaining sales from new markets is obviously going to be more expensive than just picking up some extra sales from the US, for example. Tesla has to build out a new sales and service infrastructure, along with superchargers, etc. One must wonder if it is even worth it, because as the Tesla Motors Club estimates, there were 16 European countries that saw less than 100 deliveries in 2017. If I can count an entire country's sales for a year on my fingers, can Tesla make any money there?

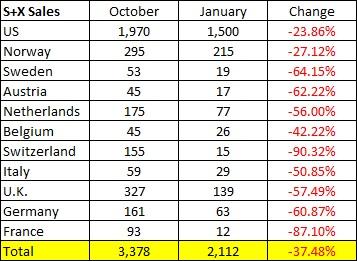

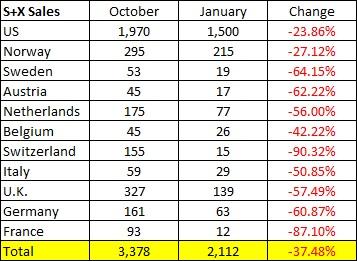

I bring up these low sales countries because it will take a large effort for Tesla to get to that 100,000 level if data from third-party sites continues to show very weak sales in Q1. In the table below, you can see how three of these tracking sites have estimates for dramatic drops in January as compared to October 2017 which was Tesla's S/X quarterly record period. Additionally, through the first 8 days of February, TeslaStats Norway estimates just 13 registrations for February, down 90% from an 136 estimated registrations in the first 8 days of November.

(Source: Tesla Motors Club European tracker, InsideEvs Monthly Scorecard, and TeslaStats Norway registrations info)

(Source: Tesla Motors Club European tracker, InsideEvs Monthly Scorecard, and TeslaStats Norway registrations info)

With a couple hours of trading underway on Thursday, Tesla shares are down a couple of percent after earnings, although part of this can likely be contributed to overall market weakness. However, the Q4 report was not very pretty when one looked beyond the headlines, and a second look at the conference call sparks even more questions. There remains a lot of skepticism of whether Tesla will hit its current production forecast for the Model 3, especially after moving back delivery estimates for many reservation holders, and that may influence when it hits its 25% margin goal. Additionally, while S/X sales are expected to be relatively flat this year, Tesla may have to spend a lot to get these sales in new markets where the business is currently not operating or very limited. The next couple of weeks should be rather interesting, as we wait for the company's 10-K filing as well as the final results of Q4 institutional holdings to see how the major holders felt about the stock as 2017 ended.

Looking to go further into this topic? See Seeking Alpha’s premium research and private communities.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Tesla: Second Look Even Worse

Feb. 8, 2018 1:04 PM ET

|

222 comments

|

About: Tesla Motors (TSLA)

Bill Maurer

Long/short equity, long only, short only, Growth

(13,376 followers)

Summary

Can new European markets gain enough Model S/X traction?

Model 3 goal timelines seem a bit confusing.

Q1 third party estimates continue to look very weak.

Late on Wednesday, I detailed my initial thoughts regarding Tesla's (TSLA) fourth quarter earnings report. While many headlines focused on the positives, like a top/bottom line beats and a reiteration of the Model 3 forecast, the quarter was tremendously helped by credit sales and working capital changes. After going through the conference call and taking another look at the published investor letter, things may be even worse than I initially thought.

The first item to note is something I only briefly touched on, and that's the possibility of more Model 3 delays. While Tesla maintained its forecast for 2,500 units of production by the end of Q1 and 5,000 by the end of Q2, it had a very cautionary statement about meeting this goal. As SA contributor Anton Wahlman expanded last night, there seems to have been a major push back of delivery timelines for Model 3 reservation holders. I also was curious about this Elon Musk's statement on the conference call:

That – with alleviating that constraint, that's what gets us to the roughly 2,000 to 2,500 unit per week production rate.

Musk is talking here about automated lines coming over from Germany to the Gigafactory, expected to arrive in March, but they have to be reassembled and then brought into production. That doesn't leave a lot of room for error if attempting to hit the end of Q1 goal, and notice how Elon said roughly 2,000 to 2,500? The bottom end of that range is 20% below Tesla's production forecast, and Tesla still then has to get these materials to the Fremont factory and into vehicles. Don't forget that Easter this year is a few weeks earlier, on April 1, so the final week of Q1 is partially a holiday week that could impact some production plans.

Another thing that struck me as odd is a statement regarding one of Tesla's biggest goals for the Model 3, the 25% gross margin figure. With delays continuing to pile up, Tesla is guiding to another negative gross margin quarter for the vehicle in Q1 2018, and this is still only while delivering the more expensive versions. While gross margins will improve as production ramps, the standard battery version that many are still waiting for will be lower margin. Also, will Tesla have to lower prices as competition arrives and Tesla consumers lose part to all of the tax credit after the 200,000 limit is reached? That gets me to two differing statements between the investor letter and conference call regarding this target:

Investor letter: Also, we are focused on achieving our target of 25% gross margin for Model 3 after our production stabilizes at 5,000 cars per week.

Conference call:

Ryan Brinkman - JPMorgan Securities LLC

Hi. Good afternoon. Thanks for taking my question. As you put solutions in place one by one to unclog Model 3 production bottlenecks in Fremont or at the battery module line in Reno, are you finding that the ultimate solution is more or less expensive to implement than your original plans, which called for 25% gross margin on the vehicle?

Elon Reeve Musk - Tesla, Inc.

I think we feel good about that. I think like – I think we probably are, we're probably able to exceed that next year, probably.

Now management is guiding to hitting the 5,000 per week mark at the end of Q2 this year, and further increasing capacity to move to 10,000 units per week, so shouldn't sustained production at 5,000 per week be like Q3 this year? By Elon saying it can exceed that gross margin target "probably" in 2018, it makes it seem like they really won't be able to sustain that 5,000 a week level for several quarters, or that the margin target won't come until quite a while after they hit the 5,000 a week rate. Perhaps I'm reading into this a little too much, but the wording just seems a little confusing here.

One thing that got my attention is Tesla's plan for the Model S and X to be at around 100,000 units this year. In the investor letter, the company attributed this to entering new markets which should allow orders to grow. If you look at the company's supercharger map for 2018, seen in the image on the right below, you'll notice a lot of plans for the expansion into countries like Turkey, Ukraine, etc. However, if you look at the image in the middle, Tesla was supposed to have these superchargers in place two years ago, and they now shown as "opening soon" in gray.

(Source: Tesla supercharger map)

(Source: Tesla supercharger map)I bring up this issue of new markets because gaining sales from new markets is obviously going to be more expensive than just picking up some extra sales from the US, for example. Tesla has to build out a new sales and service infrastructure, along with superchargers, etc. One must wonder if it is even worth it, because as the Tesla Motors Club estimates, there were 16 European countries that saw less than 100 deliveries in 2017. If I can count an entire country's sales for a year on my fingers, can Tesla make any money there?

I bring up these low sales countries because it will take a large effort for Tesla to get to that 100,000 level if data from third-party sites continues to show very weak sales in Q1. In the table below, you can see how three of these tracking sites have estimates for dramatic drops in January as compared to October 2017 which was Tesla's S/X quarterly record period. Additionally, through the first 8 days of February, TeslaStats Norway estimates just 13 registrations for February, down 90% from an 136 estimated registrations in the first 8 days of November.

With a couple hours of trading underway on Thursday, Tesla shares are down a couple of percent after earnings, although part of this can likely be contributed to overall market weakness. However, the Q4 report was not very pretty when one looked beyond the headlines, and a second look at the conference call sparks even more questions. There remains a lot of skepticism of whether Tesla will hit its current production forecast for the Model 3, especially after moving back delivery estimates for many reservation holders, and that may influence when it hits its 25% margin goal. Additionally, while S/X sales are expected to be relatively flat this year, Tesla may have to spend a lot to get these sales in new markets where the business is currently not operating or very limited. The next couple of weeks should be rather interesting, as we wait for the company's 10-K filing as well as the final results of Q4 institutional holdings to see how the major holders felt about the stock as 2017 ended.

Looking to go further into this topic? See Seeking Alpha’s premium research and private communities.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

And when the going gets tough, the top execs jump ship:

Another Tesla executive jumps ship

Feb. 8, 2018 5:33 AM ET|By: Yoel Minkoff, SA News Editor

Jon McNeill, former president of global sales and service at Tesla (NASDAQ:TSLA), will join ride-hailing company LYFT as chief operating officer.

According to filings, McNeill was given a target-driven compensation bonus of $700,000 that ended in 2017 and "there are no plans so far to search for a replacement."

Elon Musk also revealed there was "no active or passive" search for a new Tesla CEO, but at some point he might be willing to appoint someone and take on a different role more focused on product development and engineering.

Another Tesla executive jumps ship

Feb. 8, 2018 5:33 AM ET|By: Yoel Minkoff, SA News Editor

Jon McNeill, former president of global sales and service at Tesla (NASDAQ:TSLA), will join ride-hailing company LYFT as chief operating officer.

According to filings, McNeill was given a target-driven compensation bonus of $700,000 that ended in 2017 and "there are no plans so far to search for a replacement."

Elon Musk also revealed there was "no active or passive" search for a new Tesla CEO, but at some point he might be willing to appoint someone and take on a different role more focused on product development and engineering.

Sailor Dog

Elio Addict

Tesla's toast... But shorting an American company is still unamerican & gambling! Just sell TSLA & move on ...or buy some shares of ELIO.And when the going gets tough, the top execs jump ship:

Another Tesla executive jumps ship

Feb. 8, 2018 5:33 AM ET|By: Yoel Minkoff, SA News Editor

Jon McNeill, former president of global sales and service at Tesla (NASDAQ:TSLA), will join ride-hailing company LYFT as chief operating officer.

According to filings, McNeill was given a target-driven compensation bonus of $700,000 that ended in 2017 and "there are no plans so far to search for a replacement."

Elon Musk also revealed there was "no active or passive" search for a new Tesla CEO, but at some point he might be willing to appoint someone and take on a different role more focused on product development and engineering.

Last edited:

Sailor Dog

Elio Addict

TOTALLY TOAST!!!Trouble For $36,000 Tesla Model 3: Big Delay Revealed

Feb. 7.18 | About: Tesla Motors (TSLA)

Anton Wahlman

Long/short equity

Marketplace

Auto Insight For Wall St.

(2,969 followers)

Summary

Right after the Tesla 4Q 2017 conference call, we discover a major development Tesla “forgot” to tell us about in its shareholder letter or the call.

This major development is that Tesla has reportedly delayed the $36,000 version of the Model 3 by what seems like nine months.

Instead of very soon, the $36,000 deliveries will now take place in late 2018 if you were a Day 1 deposit holder (March 31, 2016), or otherwise in 2019.

That most likely means all but very few $36,000 Model 3 buyers won’t get the $7,500 Federal tax credit. But new competitors will.

How many Model 3 deposit holders will now ask for their money back? It could be a reversal of the 455,000 deposit hoopla of 2016-17.

This idea was discussed in more depth with members of my private investing community, Auto Insight For Wall St..

In what must have been the most surreal afternoon in Tesla (TSLA) history, the main surprise during the 4Q 2017 financial results conference call wasn't even that the head of sales (and service), John McNeill, left the company. And you know what they say about what to do when the head of sales leaves the company…

No, what happened wasn't even covered on the conference call at all. Instead, most of us found out an hour after Tesla's financial results call, by reading this article, from InsideEVs:

Tesla Pushes Back Standard Model 3 Deliveries To Late 2018, Early 2019.

Yes, you saw that right: The $36,000 ($35,000 plus $1,000 mandatory delivery and doc fee) version of the Tesla Model 3 has been delayed by what seems like nine months, according to the source. And you know what they say when Tesla says there's a nine-month delay? Think 18 months.

Consider this for a moment: How did Tesla not see fit to announce and explain this major development in its quarterly press release the same afternoon and on the conference call moments thereafter? Everything else that was written in the quarterly shareholder letter, and discussed on the conference call, pales in comparison to this blockbuster of a news announcement.

In case you still haven't absorbed the big news here - and I have sympathy, because it took me a few moments as well, when I saw it, as the conference call had just ended and I figured it must be an April Fool's joke - let me spell out what we found out right after the earnings call:

This is an earthquake for many - perhaps most? - Model 3 deposit holders, for several reasons:

- While Tesla had begun delivering the $50,000 (and up) version of the Model 3, which includes the $5,000 premium package, it had not yet started delivering the "standard" battery base version, which was going to be $36,000 (and up).

- Those $36,000 deliveries were set to start as early as next month, March 2018. In any case, if not in March, very soon thereafter.

- Now, as of tonight, it appears that Tesla has pushed these deliveries to late 2018 (if you placed your deposit on March 31, 2016), or to 2019 (if you placed your deposit after March 31, 2016). This according to the Insideevs and many other online posts, as this news is spreading fast this evening. Here's another prime example: Model 3 delivery estimator. And here is another one, out of more than I can now count: Gary on Twitter.

By now, you may have woken up and realized where all of this is going. If not, I'm going to spell it out for you: Tesla's much-vaunted 455,000 refundable deposits (as of August 2, 2017) may see an emphasis on "refundable."

- Bye-bye $7,500 federal tax credit. If you don't take delivery of your car by the end of 2018, you are unlikely to be eligible for the having your taxpayer-neighbor pay for $7,500 worth of your car. Your neighbor might love not having to finance your lifestyle, but for you that's a huge loss as a percentage of your car's price.

- Suddenly, you will have a lot more choices as to what other electric car to buy. In November 2018, the Kia Niro EV and Hyundai Kona EV should be arriving in U.S. showrooms, and they might be priced close to that $36,000 base price number.

- Looking into 2019, numerous other options from automakers such as Volvo, Buick (GM) and MINI also will have practical long-range EVs probably available in that $36,000 to $43,000 price range. Now that you have choices, would you even buy the Tesla Model 3 if it were available?

- Adding insult to injury, it's not only that you all of a sudden have new choices. Those cars also come attached with that aforementioned $7,500 taxpayer gift. That makes your decision even easier: Call Tesla and ask for that deposit refund.

If this nine-or-so month delay in the $36,000 base version of the Model 3 "sticks" - in other words, if the decision wasn't a computer glitch or otherwise is reversed (not impossible, I guess) - this could trigger a massive "run on the bank" in which a large portion of the 455,000 deposit holders ask for their money back.

And it's not even about the money per se. Even if 400,000 of the deposit holders withdraw, the $400 million is not material to Tesla's overall financial situation. After all, the company just lost $675 million in a single quarter, December 2017.

For Tesla, it's not about the deposit money, directly. It's about the invincible Tesla story, and about Tesla's ability to raise new shareholder capital - or debt, frankly any kind of financing it can procure - to keep itself afloat, to fight another day. Close your eyes and remember those few weeks after the March 31, 2016, Model 3 reveal. It was all about those deposits and how they enabled Tesla to raise more money very shortly thereafter.

If this deposit flow now were to reverse following the massive nine-month delay in the affordable ("mass market") version of the Model 3, then this suddenly starts to look like one big house of cards that starts to implode. That's the risk here.

Was this the only Tesla issue of importance today? Was there nothing of interest on the conference call, or in the numbers? Of course there was. But I submit that this stealth development, apparently right after the conference call, is vastly more consequential to the Tesla's future in the stock market.

Disclosure: I am/we are short TSLA.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: At the time of submitting this article for publication, the author was short TSLA and long GM. However, positions can change at any time. The author regularly attends press conferences, new vehicle launches and equivalent, hosted by most major automakers.

I don't know how long Tesla can sustain burning that much money with no end in sight (in the billions) before somebody steps in to do damage control. I'm not even sure if Elon Musk is managing sleep over this. In my honest opinion only, if I have the money to buy a brand new base or upgraded Tesla 3, which will be close to 50K OTD, I would rather buy a used Tesla 100 or even the 100D which is far more luxurious, longer range and 0-60 mph in what...3.5 sec.????? But then I wouldn't have to worry about that....because I don't have that kind of money anyway. But I bet I would get my used Chevy BOLT sooner than the guy that holds reservation # 400,001!I agree RickB. And it shouldn't be a surprise to everyone what Tesla Motors are going through from the beginning- announcing an "affordable" Tesla 3 way cheaper than their current 100K version will and had created so much hype, thousands of reservations poured in and now they can't keep up with production- but at least they're delivering. Relate this to ELIO motors announcing an unheard of target price of 7K for an ELIO- same thing, it created hype and reservations poured in but the similarities ends there as EM have to find money to back up what they've started. Scaling production needs tons of money and without it, that's what we can expect from Arcimoto and EMV- a few units here and there while we all wait impatiently. As for ELIO, FUHGETABOUTIT!

johnsnownw

Elio Addict

Negative articles always follow quarterly results. Each quarter the same doom and gloom articles of the impending Tesla implosion.

I look forward to the next several quarters of the same, only with modified reasons as to why Tesla is failing since the others didn't quite come to fruition.

I look forward to the next several quarters of the same, only with modified reasons as to why Tesla is failing since the others didn't quite come to fruition.

America needs Tesla, it created thousands of jobs, it's the only company big enough to really challenge the ICE car makers to step up and clean their act (going green). The big government needs Tesla and if needed, it will step in. I have no idea how much of the 400-500K reservations are foreign holders but when Tesla eventually delivered all units, it'll be fun to see model 3's running around all over America's streets and freeways. It's an American success story we sure don't want to see fail.Negative articles always follow quarterly results. Each quarter the same doom and gloom articles of the impending Tesla implosion.

I look forward to the next several quarters of the same, only with modified reasons as to why Tesla is failing since the others didn't quite come to fruition.