Well then how about this?

Tesla: How About Some Facts?

Mar. 15, 2018 12:04 PM ET

|

Bill Maurer

Long/short equity, long only, short only, Growth

CNBC article details more quality issues.

Company denies problems, but response misses key point.

How about some real information?

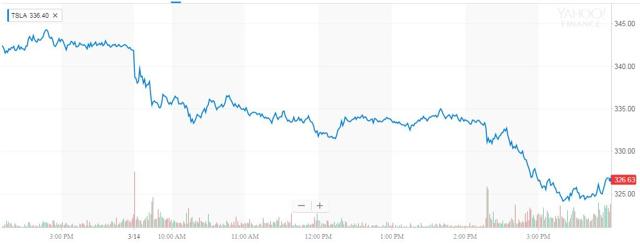

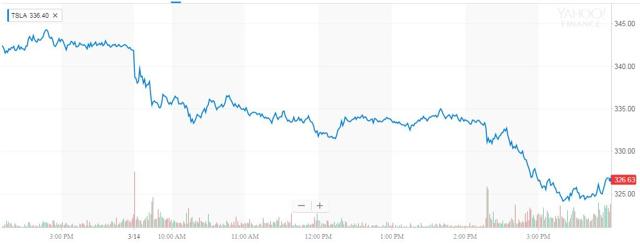

Wednesday was not a good day for shares of Tesla (TSLA), as seen in the chart below. Initially, shares declined a little on news of another executive departure, again a major finance head, but later in the day another leg down took place after CNBC reported about more vehicle quality problems. As can be expected, Tesla issued a response to refute the CNBC article, but some major questions remain. Perhaps the company should detail some actual facts if it wants to be believed.

(Source: Yahoo Finance)

(Source: Yahoo Finance)

On Tuesday, Susan Repo left Tesla for a position in another company. She was the company's Corporate Treasurer and VP of Finance, and was replaced by the Assistant Treasurer. This came just a week after the company's Chief Accounting Officer left. While some may wonder how important Repo was to the business, an article about a national battery organization stated the following, which seems important to me (bold is mine).

At Tesla, Ms. Repo is responsible for shaping and building capital structure, including liquidity and liability profiles to scale with the world’s largest hyper-growth sustainable energy company.

The CNBC article discussed the issue of rework and re-manufacturing. One engineer cited in the piece estimated that 40 percent of the parts made or received at Fremont needed rework. One auto expert also questioned how Tesla referred to re-manufacturing in terms of new part production. Another employee said that the defect rate is so high that it is hard to hit production targets, hurting morale. Part of the company's response can be seen in this electrek piece.

However, the response falls flat in a few places. First of all, the biggest quality issues that are predominantly in the media are regarding the Model 3, like misaligned panel gaps, software issues, etc. In that electrek article, the full response from Tesla does not once mention the Model 3. Also, there is the following statement about the re-manufacturing team:

CNBC is extracting a few lines from two job descriptions posted online and making gross assumptions about the roles that are inaccurate. Our re-manufacturing team is very small, comprising only 0.1% (40 people) of our nearly 40,000 employees.

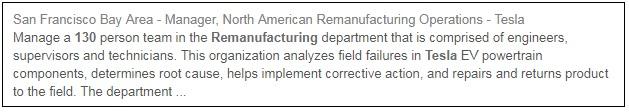

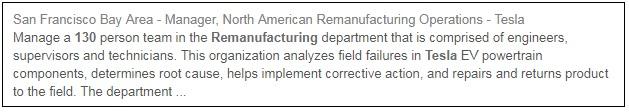

Unfortunately, Tesla probably should have done some homework before including this statement, or tried to clarify what exactly they mean by team. I did a Google search based on a few keywords, and the fourth result can be seen below. This is a person that has a title of "Manager, North American Remanufacturing Operations," with the following job description. Who do you believe here?

(Source: Google search done by author, employee name removed)

(Source: Google search done by author, employee name removed)

If Tesla wants to be believed, maybe the company should provide some hard facts to support its rebuttals. The company and its executives don't exactly have a strong track record. Just repeating that consumer satisfaction is high ignores the issue at hand, and not mentioning the Model 3 at all is a big red flag. The fact that Tesla has pushed back its production timeline on the newest vehicle to focus on quality tells you that there are issues.

Additionally, the electrek article was written by one of Tesla's biggest supporters, who in his concluding remarks stated that he believes the company has delivered between 5,000 and 8,000 Model 3 vehicles since last year's production start. Given Tesla had produced almost 800 in the final 7 working days of 2017 and is supposed to be at 2,500 per week just two weeks from now, it seems that a major supporter is saying the company is going to miss another deadline by a wide margin. That seems to be supported by the Bloomberg tracker, which still sits well under 1,000 units a week for Model 3 production. Meanwhile, as I detailed in my previous article, items like cobalt prices and LIBOR rates continue to soar, providing more and more headwinds for Tesla.

Tesla shares fell on Wednesday as the bad news continued to pile up. First, another major finance executive bailed, then a CNBC article talked about part quality issues and re-manufacturing. Tesla tried to refute the piece, but I question their statements given what one employee posted and other items we've heard about in the past. Additionally, if the company says it is inspecting every vehicle before a customer gets one, why are we seeing vehicles like the one below? Maybe some facts would help, like the current production rate of the Model 3.

Tesla: How About Some Facts?

Mar. 15, 2018 12:04 PM ET

|

Bill Maurer

Long/short equity, long only, short only, Growth

CNBC article details more quality issues.

Company denies problems, but response misses key point.

How about some real information?

Wednesday was not a good day for shares of Tesla (TSLA), as seen in the chart below. Initially, shares declined a little on news of another executive departure, again a major finance head, but later in the day another leg down took place after CNBC reported about more vehicle quality problems. As can be expected, Tesla issued a response to refute the CNBC article, but some major questions remain. Perhaps the company should detail some actual facts if it wants to be believed.

(Source: Yahoo Finance)

(Source: Yahoo Finance)On Tuesday, Susan Repo left Tesla for a position in another company. She was the company's Corporate Treasurer and VP of Finance, and was replaced by the Assistant Treasurer. This came just a week after the company's Chief Accounting Officer left. While some may wonder how important Repo was to the business, an article about a national battery organization stated the following, which seems important to me (bold is mine).

At Tesla, Ms. Repo is responsible for shaping and building capital structure, including liquidity and liability profiles to scale with the world’s largest hyper-growth sustainable energy company.

The CNBC article discussed the issue of rework and re-manufacturing. One engineer cited in the piece estimated that 40 percent of the parts made or received at Fremont needed rework. One auto expert also questioned how Tesla referred to re-manufacturing in terms of new part production. Another employee said that the defect rate is so high that it is hard to hit production targets, hurting morale. Part of the company's response can be seen in this electrek piece.

However, the response falls flat in a few places. First of all, the biggest quality issues that are predominantly in the media are regarding the Model 3, like misaligned panel gaps, software issues, etc. In that electrek article, the full response from Tesla does not once mention the Model 3. Also, there is the following statement about the re-manufacturing team:

CNBC is extracting a few lines from two job descriptions posted online and making gross assumptions about the roles that are inaccurate. Our re-manufacturing team is very small, comprising only 0.1% (40 people) of our nearly 40,000 employees.

Unfortunately, Tesla probably should have done some homework before including this statement, or tried to clarify what exactly they mean by team. I did a Google search based on a few keywords, and the fourth result can be seen below. This is a person that has a title of "Manager, North American Remanufacturing Operations," with the following job description. Who do you believe here?

If Tesla wants to be believed, maybe the company should provide some hard facts to support its rebuttals. The company and its executives don't exactly have a strong track record. Just repeating that consumer satisfaction is high ignores the issue at hand, and not mentioning the Model 3 at all is a big red flag. The fact that Tesla has pushed back its production timeline on the newest vehicle to focus on quality tells you that there are issues.

Additionally, the electrek article was written by one of Tesla's biggest supporters, who in his concluding remarks stated that he believes the company has delivered between 5,000 and 8,000 Model 3 vehicles since last year's production start. Given Tesla had produced almost 800 in the final 7 working days of 2017 and is supposed to be at 2,500 per week just two weeks from now, it seems that a major supporter is saying the company is going to miss another deadline by a wide margin. That seems to be supported by the Bloomberg tracker, which still sits well under 1,000 units a week for Model 3 production. Meanwhile, as I detailed in my previous article, items like cobalt prices and LIBOR rates continue to soar, providing more and more headwinds for Tesla.

Tesla shares fell on Wednesday as the bad news continued to pile up. First, another major finance executive bailed, then a CNBC article talked about part quality issues and re-manufacturing. Tesla tried to refute the piece, but I question their statements given what one employee posted and other items we've heard about in the past. Additionally, if the company says it is inspecting every vehicle before a customer gets one, why are we seeing vehicles like the one below? Maybe some facts would help, like the current production rate of the Model 3.